owe state taxes illinois

That makes it relatively easy to predict the income tax. Your average tax rate is 1198 and your marginal tax rate is 22.

State Taxes On Capital Gains Center On Budget And Policy Priorities

Whos Eligible for an Illinois State Tax Payment Plan.

. It is possible to owe Illinois taxes and get a refund from your federal return in the same year. Payments less than 31 days late are penalized at 2 of the amount due and payments 31 days late are. This marginal tax rate means.

April 10 2020 636 PM. Conversations about Gender Norms and Expectations at 6 pm. Up to 25 cash back If your estate owes estate tax how much will it actually owe.

Owe state taxes illinois Tuesday August 16 2022 Edit. Remember that in Illinois you pay taxes on the entire estate if it is above the 4. The only problem is that I wasnt living or working in Illinois for.

The first bill we send you will contain a detailed breakdown of the tax penalty and interest you owe an explanation of why. If you owe past-due tax we will charge you penalty and interest. In Illinois the tax rate currently ranges from 08 to 16 depending on the size of the estate.

The taxes collected from your paycheck are based on how you filled out your W4 paperwork not your actual taxesThe tax return is to see what your. If the winner opts to take the full 1 billion in winnings over 30 years they will receive annual payouts of 333 million on average before taxes. The estate tax rate for Illinois is graduated and the top rate is 16.

The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate. All taxpayers who are current with their tax returns are eligible to apply for a state of Illinois tax payment plan. Federal and state tax laws and regulations are not the same.

While the 24 federal tax. Illinois Estate Tax Rate. If you make 70000 a year living in the region of Illinois USA you will be taxed 11737.

The Illinois Federal State Exchange is saying I owe them 10k in back taxes for not filing in 2017 and 2018. 4 hours agoArtist Alex Martin will be leading the discussion Nonbinary Doesnt Owe You Androgyny.

Irs Tax Debt And Divorce In Illinois Russell D Knight

Illinois Department Of Revenue Idor 1 Rcn Letter Sample 1

Various Tax Relief Options For Illinois Back Taxes

Illinois State Tax Software Preparation And E File On Freetaxusa

Where S My Illinois State Tax Refund Il Tax Brackets Taxact

Illinois State Offer In Compromise Overview For Income Taxes

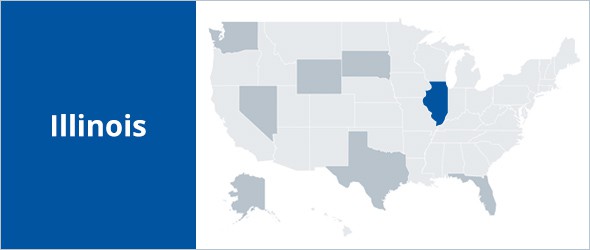

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

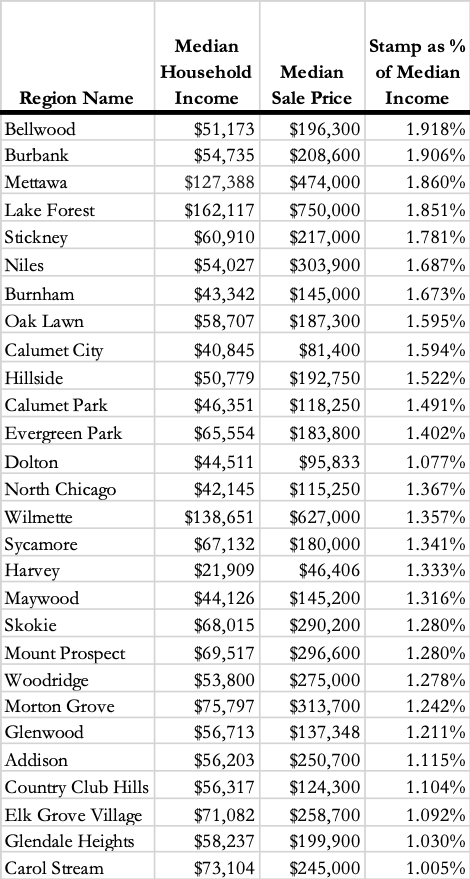

Illinois Taxes The High The Low And The Unequal Chicago Magazine

Illinois Income Tax Calculator Smartasset

Illinois Self Employment Tax Calculator 2020 2021

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

S Corp Illinois Filing Process For Small Businesses

Illinoisans Can Submit State And Federal Tax Returns Starting January 24

Welcome To The Illinois Department Of Revenue

Llc Tax Calculator Definitive Small Business Tax Estimator

How To Pay Illinois Sales Tax Online 9 Steps With Pictures